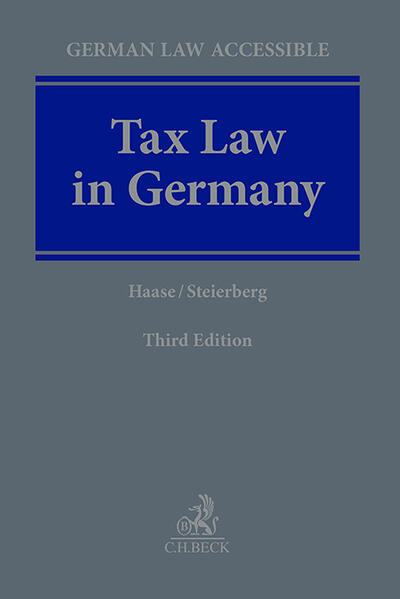

Tax law in Germany

| Autor | |

| Quelle | Sonstige Datenquellen |

| ISBN | 978-3-406-79375-2 |

| Lieferbarkeit | lieferbar |

| Katalogisat | Basiskatalogisat |

| Verlag | C.H.Beck |

| Erscheinungsdatum | 12.01.2024 |

Beschreibung (Langtext)

This book gives a compact overview of German tax law and explains its key features, focusing in particular on the tax consequences for foreign investors when investing in Germany as well as the international aspects of German tax law.

Introducing the reader to the German tax law, it continues to give an overview of the German tax system and goes on to cover topics, such as: taxation of individuals and companies; tax treaties; CFC regulations; investments through German corporations and partnerships; taxation of direct transactions; double taxation agreements; area-specific tax law; further issues such as employee secondments, financing, etc.

In addition to a general update, the third edition takes into account the reform projects initiated as a result of the OECD BEPS project, especially the innovations in the area of supplementary taxation, transfer pricing and taxation of permanent establishments.

The authors share their practical experiences and examples from daily work to guide foreign investors, tax advisors, academics and anyone interested in tax law through the German tax jungle.

German Law Accessible

Haase/Steierberg

Tax Law in Germany°

In English

By Prof. Dr. Florian Haase, M.I.Tax, and Daniela Steierberg, LL.M.

3rd edition. 2024 Approx. 330 pages. Hardcover approx. Euro 128,-

ISBN 9783406793752

The Book

The book explains the key features of German tax law, focusing in particular on the tax consequences for foreign investors when investing in Germany as well as the international aspects of German tax law.

Advantages at a GlanceCompact English language overview of German tax lawPractice-based and clear presentation through case studies and tax planning strategies

The New Edition

In addition to a general update, the new edition takes into account in particular the reform projects initiated as a result of the OECD BEPS project, especially the innovations in the area of supplementary taxation, transfer pricing and taxation of permanent establishments.

Target Group

For international companies, investors and wealthy individuals who are or seek to be active in Germany, internationally active legal advisors who require an overview of German tax law, and providers of linguistic services.